After 34 years in corporate America, Jayne realized there was a niche she was uniquely suited to fill and has launched a financial coaching business aimed at empowering women financially.

Tell us a little about your background.

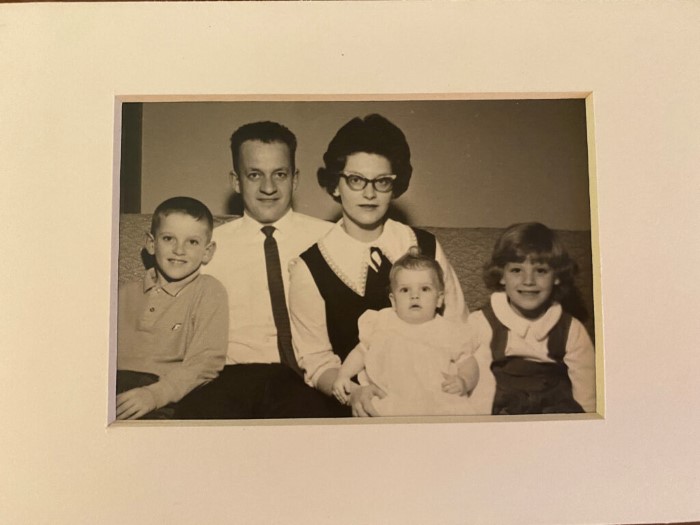

I grew up in International Falls, MN (ice box of the nation) in a very outdoorsy family. I was the baby of three and definitely the “girly girl.” We went camping, fishing, and swimming in the summer and snowmobiling and cross-country skiing in the Winter.

Family photo with my mom, dad, sister and brother – I’m the cute baby!

I attended the College of St. Scholastica in Duluth, MN to study Physical Therapy. However, I quickly realized I didn’t really like the sciences, so I switched to Business Management. I also had the opportunity to do a study abroad program in Ireland, where I met relatives and saw the church where my great, great grandparents were married. It will always hold a piece of my heart.

After graduation, I continued to move South, to the Twin Cities. There I met my wonderful husband, Nathan, of 29 years. As he tells the story, I was at his house waiting for him when he came home one night, and the rest was history. Our son, Tyler and his wife Steph, live ten minutes from us. They were high school sweethearts—sort of, well not really—but he won her over in the end. Tyler was an avid hockey player and much of our time while he was growing up was spent in ice arenas all over the state of Minnesota (and Wisconsin, Illinois, and New York). The community and friendships we all formed along the way made this a very special time.

Nathan and I bought a cabin on a small lake near Danbury, Wisconsin, 19 years ago and have treasured the memories we have shared with family and friends. Nathan and I enjoy a long walk most mornings, then I go off to paddleboard or kayak, visiting with the neighbors in the bay as I glide by, getting my social fix. A ride on the pontoon boat or the four-wheeler is typically in the mix as well. Winter consists of a roaring fire, a good book, a puzzle, and cross-country skiing.

On the paddleboard at the cabin with my Grand-dog Oakley

Our vacations typically involve the ocean with some of our favorite spots including Maui, Grand Cayman, the Caribbean, Ireland, Cozumel, and Marco Island. Although I would have to say the ultimate trip was Australia and New Zealand when Tyler did his study abroad in Sydney. Snorkeling at the Great Barrier Reef was spectacular! Did I mention I love to travel?!?!

I had an amazing 34-year career in corporate America, creating wonderful relationships with both colleagues and clients along the way. I started my career in investments working for one of the wealthiest families in the United States, the owners of Cargill, Incorporated. I had never even heard of a family office. But that was where I learned all about investments. It was an incredible experience. It also allowed me to easily establish trust and credibility with clients.

My next stop was with Piper Jaffray, an investment banking firm. There I was a member of a team that built a multi-family office offering working with founders and executives of companies that were going through a liquidity trigger event, like an initial public offering (IPO) or merger and acquisition (M&A) deal.

Finally, I spent 13 years at U.S. Bank as a Managing Director leading a team of Portfolio Managers and working with clients. I personally managed $800 million of assets under management (AUM) and supervised a team managing $5 billion AUM.

All of these experiences gave me the opportunity to work with individuals, families, and foundations as well as with their attorneys, accountants, and other advisors. Taking a holistic approach and considering all aspects of their financial situation provided a wonderful perspective.

Top Women in Finance awards banquet

When did you start to think about making a change?

About seven years ago, a colleague of mine was diagnosed with brain cancer. About a month before he passed away, we were both going to be on vacation in Maui with our families and were hoping to get together. We didn’t connect and afterwards, I asked him how the trip was. He said, “Well it was great, except I had a hard time finding a Wall Street Journal every day.” I responded, “Well it wasn’t a problem for me because I wasn’t looking for one.” He said, “Jayne, you don’t understand, this is my passion.” That was when it hit me like a brick wall. This wasn’t MY passion. I decided it was time to figure out what I wanted to do next.

While still working full-time, I hired a life coach to explore my next move. At the end of our coaching, I told her, “I want to do what you do!” I started taking coaching classes and gained some certifications on that front. I didn’t really know where it was all leading.

Then I noticed a pattern at work. I would meet with my clients, typically husband and wife. Often, not always, the wife would glaze over, as much as I tried to engage her. Down the road, the husband might die or there was a divorce, and the wife would be thrown into a scary situation. She now needed to understand the financial situation urgently. I kept thinking to myself, who can provide the education these women need?

I decided that person needed to be me. I was uniquely qualified, with my financial expertise and coaching credentials. I left the corporate world to start on my new venture.

What is your next act?

I started Ellegant Wealth in April 2019 to “empower women to show up and own their financial journey with Courage, Confidence & Wisdom!” I spent the first six months creating the curriculum I wanted to provide women. I call it the Six Pillars to Financial Empowermenttm. I wanted to make it female-friendly (but not dumbed down), using language that would draw women in rather make them feel excluded. This industry has been very male-dominated and masculine. Built for men by men. I believe that is part of the reason women haven’t found it interesting and haven’t engaged in the conversation.

Women learn collaboratively, so I chose to offer “Ellegance for Women” as a group coaching experience. I bring together 8-12 women in-person to share their stories and ask their questions in a safe space. Seeing the community and the connections between the women and the depth of learning that resulted was absolutely magical! I had just completed my fourth offering of this model when the pandemic hit.

Initial “Ellegance For Women” Group

As a result, I have been creating a new virtual/digital offering, “Financial Wellness for Women,” in two versions. The do-it-yourself version of my program will be available beginning October 1, 2020, complete with videos, handouts/exercises, articles, resources, etc. On October 1, 2020, I will also be launching a hybrid version of this same program that will also include a weekly 60-minute live Zoom session. This will provide the community and connection that was so beautiful with the in-person groups.

I absolutely love the difference I’m making in women’s financial lives. The women who have participated in the groups have had amazing things to say about how this has transformed their relationship with money. They have been motivated to get engaged in the conversations impacting their financial future and to be more intentional about taking control of their money situation.

I am delighted to be on this entrepreneurial adventure and fulfilling what I know is my passion and believe with all my heart is my purpose.

In my home office

How hard was it to take the plunge?

I hit the magic age of 55 and my options vested, so I no longer had the golden handcuffs holding me in place. I had been utilizing the tuition reimbursement program over the past few years to take some of the coaching programs (which also benefited the company). I also had been deferring some of my compensation, with the thought that I would be able to use that money to start a business. I was reading a lot of books on coaching and starting a business.

I was really ready mentally to make the shift, so it wasn’t as hard as I thought it would be. I was also so excited about my concept and what I was setting off to do that I could hardly contain myself. I felt I had identified a niche that needed to filled and I wanted to get out there and make it happen.

How supportive were your family and friends?

My husband was very supportive and encouraged me to make the change. My mother was a little more nervous about it, concerned that I was so young to be “retiring” and making this shift. I think most people were surprised. But when I would start telling them about what I planned to do, my enthusiasm usually convinced them that I was making the right decision.

Cross-country skiing with my husband, son and daughter-in-law (I’m in the blue jacket)

What challenges are you encountering?

I thought I had built-in referrals through my large network of Financial Advisors/Planners, but found that even though I am not competing with them, but am complementary to them, most weren’t inclined to refer their clients. So I spent a lot of time meeting with the wrong potential partners. Now I am looking to partner with other coaches who have a similar audience but offer something different.

My business model was focused primarily on holding in-person group coaching sessions and I planned on attracting women to those through in-person speaking engagements. That completely fell apart with COVID. I am about to roll out a new digital/virtual course that can be done at home. I have also lined up a number of virtual speaking engagements.

Social media and technology have been challenging. In the corporate world I didn’t need to focus on either of these things, so the learning curve has been steep. I’m making progress on both fronts!

What did you learn about yourself through this process?

That I am extremely capable of learning new things. I can figure it out, and it’s incredibly rewarding when I do. I am also far more resilient than I thought. When a curveball is thrown my way, I may not be the fastest at making the necessary pivot, but I get there. I figure out a different way of achieving the goal I’ve set. I’ve always known I can be like a dog with a bone when it’s something that’s really important to me. And this is the most important thing I feel like I’ve ever done, so I’m tough to distract!

Giving my welcome/thank you speech at Ellegant Wealth Launch Party

Looking back, is there anything you’d have done differently?

I wish I had been more engaged in social media, that I’d built a stronger presence and following before I left my corporate job.

I also wish I’d spent time learning more about all the technology it takes to run a business. I could have been taking courses and learning before I left so I could have hit the ground running a little faster!

What advice do you have for women seeking reinvention in midlife?

Do as much planning as you can, but at some point, take the leap! Follow your passion. You have a gift to give others and you will be ignited by the energy and enthusiasm.

Find a community of like-minded women as quickly as possible. Having others to bounce ideas off and share your wins, your frustrations, your concerns, your excitement is wonderful. Find out how you can help each other. Support one another in the way that is meaningful to each person. It probably isn’t the same for everyone—so ask!

Celebrating with a few of my tribe!

What advice do you have for those interested in becoming financial coaches?

Don’t get hung up on having all the right credentials. I’ve talked with a number of women who have been pushed to learn about finances due to circumstances like getting themselves into debt (and then out of debt), going through a divorce, or losing a spouse. Being able to share that you’ve been in their shoes helps others relate to you. There can’t be enough of us sharing financial wisdom with others. If it’s something that comes easily to you and you enjoy teaching and talking about it, then it’s definitely worth looking into!

I would be happy to have a conversation with anyone considering this path.

What resources do you recommend?

For women looking to gain additional education, I have a complete list of resources (with links) included in the 3-Step Guide to Shifting Your Money Mindset. Here are a few of my favorites:

Books

On My Own Two Feet: A Modern Girl’s Guide to Personal Finance by Manisha Thakor

Women With Money: The Judgement-Free Guide to Creating the Joyful, Less Stressed, Purposeful (and, Yes, Rich) Life You Deserve by Jean Chatzky

Podcasts

So Money with Farnoosh Tarabi

ProfitBoss Radio with Hilary Hendershot

Websites

Napkin Finance

Ellevest

For those interested in learning more about the career path of a financial coach, here are some groups/programs that could be helpful:

Financial Coaches Community and Financial Coaches Unite

Coach Connections, Financial Coach Academy and Financial Fitness Coach – training programs

What’s next for you?

Growing Ellegant Wealth! A former client, who has been incredibly supportive of this initiative, say he thinks what I’m doing is incredibly needed and he hopes I make millions doing it. I want to make a difference. If I can help divorcees or widows understand their financial situation or prevent some women from having to suffer the financial overwhelm that often happens when experiencing a significant life event, I will consider it a success. I want to reach as many women as possible. First, I need to raise awareness that I’m here to help. That I can simplify the learning process and make it enjoyable along the way. Thank you for helping me share my message!

Connect with Jayne Ellegard

Email: jayne@ellegantwealth.com

Website: www.ellegantwealth.com

LinkedIn

Facebook

Ellegant Wealth Facebook Group

Jayne!

Congratulations on your great success!

As your former dance teacher, I knew there was a lot of energy, determination, discipline in that little body of yours. You already showed signs of “ never giving up.”

Ellegant Wealth is thriving. How could it not with you at the helm?

Your mom, Phyllis St.Pierre Karsnia, and your family, must be so proud of you.

I am, from a distance.

Marcelle St.Pierre Schaefer

Ohmygosh Marcelle – so wonderful to hear from you! I can picture you now teaching us moves and then combining them together into a beautiful dance. You had to work hard with me as there wasn’t much natural talent, but you took a very clumsy young girl and gave me far more grace than I would have had otherwise! Thank you for your patience and guidance.

I hope you are doing well:-)

Hugs!

Jayne